In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Tocagen Inc. (NASDAQ:TOCA) reported that Biotechnology Value Fund L P has picked up 846,742 of common stock as of 2017-04-21.

The acquisition brings the aggregate amount owned by Biotechnology Value Fund L P to a total of 846,742 representing less than 4.6% stake in the company.

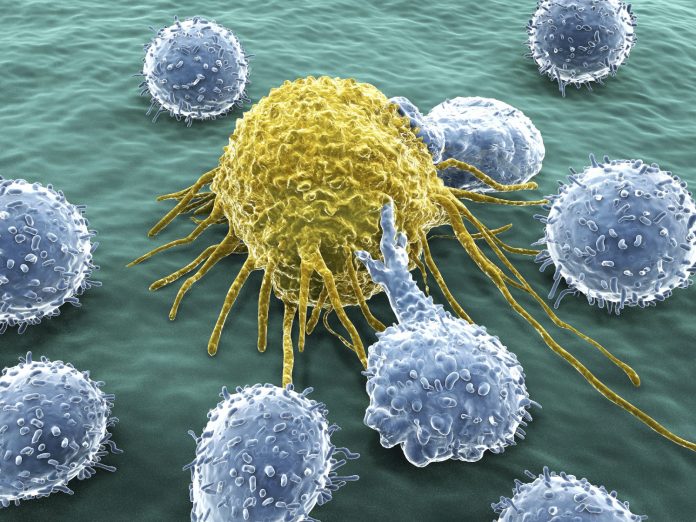

For those not familiar with the company, Tocagen Inc., (Tocagen) is a clinical-stage, cancer-selective gene therapy company. The Company is focused on developing product candidates designed to activate a patient’s immune system against their own cancer. Its cancer-selective gene therapy platform is built on retroviral replicating vectors (RRVs), which are designed to selectively deliver therapeutic genes into the deoxyribonucleic acid (DNA) of cancer cells. Its lead product candidates are vocimagene amiretrorepvec (Toca 511) and flucytosine extended release (Toca FC). Toca 511 is an investigational injectable retroviral replicating vector (RRV) that encodes a prodrug activator enzyme, cytosine deaminase (CD). Toca FC is an investigational extended-release version of 5-fluorocytosine (5-FC), a prodrug that is inactive as an anti-cancer drug. As of February, 2017, Tocagen has completed enrollment of the Phase II portion with 187 patients.

A glance at Tocagen Inc. (NASDAQ:TOCA)’s key stats reveals a current market capitalization of 221.36 Million based on 18.50 Million shares outstanding and a price at last close of $13.27 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-04-19 Das picked up 2,500 at a purchase price of $10.00. This brings their total holding to 2,500 as of the date of the filing.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Tocagen Inc. (NASDAQ:TOCA) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.