In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Mgm Resorts International (NYSE:MGM) reported that Tracinda Corp has picked up 71,173,744 of common stock as of 2017-02-17.

The acquisition brings the aggregate amount owned by Tracinda Corp to a total of 71,173,744 representing a 12.4% stake in the company.

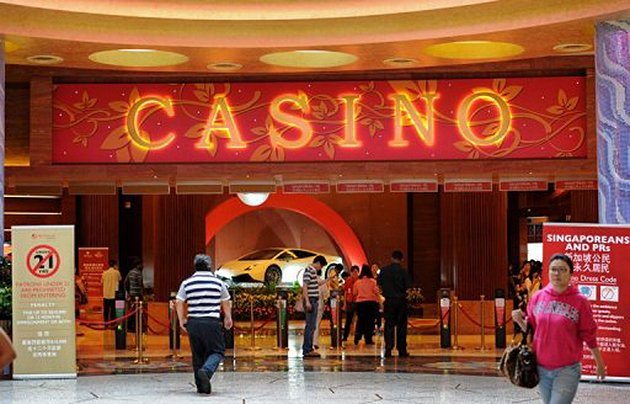

For those not familiar with the company, MGM Resorts International is a holding company. The Company owns and operates casino resorts. It operates in two segments: wholly owned domestic resorts and MGM China. Its casino resorts offer gaming, hotel, convention, dining, entertainment, retail and other resort amenities. It has additional business activities, including its investments in unconsolidated affiliates, and other corporate and management operations. Its wholly owned domestic resorts consisted of casino resorts in Las Vegas, Nevada, which includes Bellagio, MGM Grand Las Vegas, Mandalay Bay, The Mirage, Luxor, New York-New York, Excalibur, Monte Carlo and Circus Circus Las Vegas. It also operates other casinos, which includes MGM Grand Detroit in Detroit, Michigan; Beau Rivage in Biloxi, Mississippi, and Gold Strike Tunica in Tunica, Mississippi. MGM China’s operations consist of the MGM Macau resort and casino and the development of an integrated casino, hotel, and entertainment resort on the Cotai Strip in Macau.

A glance at Mgm Resorts International (NYSE:MGM)’s key stats reveals a current market capitalization of 13.84 billion based on 574.12 Million shares outstanding and a price at last close of $26.60 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-03-11, Grounds picked up 1,250 at a purchase price of $20.77. This brings their total holding to 1,250 as of the date of the filing.

On the sell side, the most recent transaction saw D’arrigo unload 19,069 shares at a sale price of $30.07. This brings their total holding to 121,222.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Mgm Resorts International (NYSE:MGM) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.