If you’re already a crypto collector, all I need to do is to say Global Blockchain Technologies Corp. (OTCKMTS:BLKCF) The overhang has lifted and it’s time to pick your spot in the new world. You know what to do.

For most of us, a “fork” is a crossroads or a turning point. It’s the moment when the models shift and stocks need to pivot to match. After the fork, the world is different. But within a narrow window of time, everyday traders have a chance at upside potential . . . provided, of course, that they commit before the window closes.

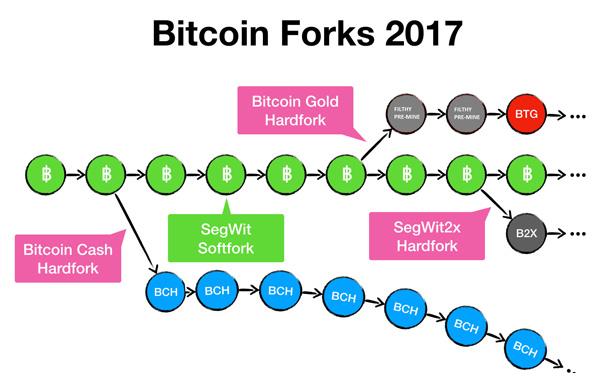

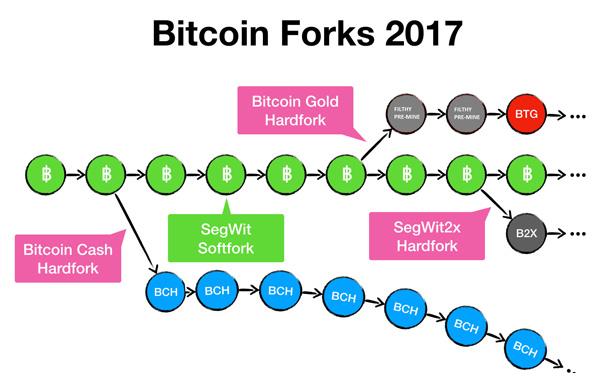

Think back to the craziness around the king of crypto currencies, Bitcoin. Bitcoin hit fork after fork last year, at least 4 big ones and so many little ones the experts literally gave up counting them. Bitcoin was forking every other DAY as recently as December, each of them creating a new binary path, a “before-and-after” world.

Welcome the FORK

Sometimes the forks spawned whole new currencies. Bitcoin gave birth to Bitcoin Cash, then Bitcoin Gold, each with its own story and gain profile, not to mention secondary spinout opportunities. Traders went berserk. And the “original” currency swung in huge circles but ultimately ended the year 1,300% more valuable than when it started.

For all practical purposes, BLKCF just hit one of those forks. Shareholders of BLKCF as of March 1st are in line to receive stock in its wholly owned subsidiary, Global Blockchain Mining Corp. (its proposed trading symbol is FORK). There’s potential for an OTC version south of the border as well.

The fork has happened. But if you missed the turn, don’t spend too much time crying. BLKCF will finally be free to show the world its potential.

Load the chart and let’s look between the lines:

On the surface, it looks like a standard consolidation channel. BLKCF went on a 1,100% bull run last year. It’s still up 300% plus from the lowly $0.10 where it traded as recently in August.

Any stock like that needs a little time to catch its breath, and with Bitcoin mania pausing, BLKCF went back to fill the big gap. Under normal circumstances, that would be the end of it. We’d talk about the way the implied tops and bottoms are converging, gauge the growing odds of the next breakout to come.

This is not “normal circumstances.” There’s a FORK in the recent road that throws off all the standard math.

The spinout terms shifted a lot of the top layer of sizzle out of BLKCF and into that new stock. FORK gets all the assets that spin up beautiful Bitcoins from raw computer power — that’s the Manitoba and Mozambique mining operations, the “distributed processing” unit. All in all, that’s 175 megawatts running 24/7/365.

Bye-Bye, Bitcoin (For Now)

Last I checked, that’s enough to create 175 Bitcoins per HOUR. All on the FORK side of the “family.” When that operation ramps up the back of my envelope says the ultimate revenue there could be vast.

It’s a big target. FORK shareholders could be in for a real treat. But here’s the thing: the BLKCF stock price barely even BLINKED!

For more info and updates on BLKCF, subscribe here:

Even after the proposed spinoff, BLKCF trades within sight of where it did right before the split. Yeah, management also forward split 1:1 at the same time, but that’s already factored into the chart up there.

BLKCF minus FORK equals largely unchanged. Normally you’d expect the market cap to go down to reflect the fact there are now two stocks splitting up the space only one occupied before. And yet depending on the timeframe you look at, the share price has actually edged UP . . . even though there’s a dramatically different asset mix in there now.

That’s Bitcoin logic. A fork doesn’t have to obey normal “1 split in half = half plus half” rules. Sometimes, as even the glossy magazines like FORTUNE have realized, “1 split in two = 1 plus a little bit extra.” BLKCF split. FORK, with its entire Bitcoin bonanza factor, doesn’t even trade yet but it’s already been factored out of BLKCF.

When FORK hits the market, that stock could be that “little bit extra.” If you were in BLKCF before March 1, 2018, what is happening now is that market value has been created here out of the equivalent of thin air. That’s something hardened traders don’t see every day, to put it mildly — the equivalent of a MARKET MIRACLE!

But if traders today think BLKCF rates roughly what it did before stripping out that massive FORK, the remaining assets here must be pretty compelling, right? Time to take a look at what the all-new BLKCF includes and where it can go now that the pure Bitcoin piece is gone.

Roll Up To Pure Blockchain

BLKCF has always been all about the blockchain technologies. It’s right there in the name of the company, Global Blockchain Technologies Corp. (OTCMKTS:BLKCF). Blockchain is the computing model that supports Bitcoin and every other crypto currency developed lately. You might be familiar with the metaphor of how the smart money sells shovels to gold miners? Blockchain is the shovel.

Now that BLKCF has proposed to spin out its Bitcoin “mine,” it’s a pure shovel company. As the latest press release puts it, the stock we can trade today comprises the “investments, agreements, partnerships and independent in-house initiatives to create and incubate Internet scale public blockchains, enterprise solutions, tokens and ICOS.”

That’s a lot of Silicon Valley buzz mashed into a single sentence so management breaks it down in a little more detail:

- Trade finance in conjunction with major State actors

- Enterprise peer to peer storage solutions

- Ethereum hard fork with features that enhance it as a global payment rails solution (the Laser Blockchain)

- Tokenization of 3 incumbent gaming networks with over 200 million users including functionality for both e-sports and gambling

- Decentralized marketplace for big data geared towards the multi-trillion dollar “Internet of Things” industry

- Peer to peer fully decentralized lending marketplace built on the Laser Blockchain

- Securitization platform for artworks including music, video and brands in partnership with some of the world’s most recognizable artists, brands and studios, something not possible before the advent of blockchain

- Launch of an Exchange federated on the Stellar network with leading FOREX and remittance partners to be announced

- Launch of a cryptocurrency exchange with State backing

That’s a lot to digest. BLKCF apparently wants to get involved with government blockchains, maybe even helping out with a formally regulated crypto currency exchange — probably a good thing given all the hacks and cracks lately. They want to attach blockchains to loans, again an interesting idea. Maybe that’s a new kind of credit score system, maybe it’s an automated collateralization or repo where the loan itself “knows” when you’ve defaulted.

(One of the hot aspects of blockchain is “smart contracts” that enforce themselves, by the way. Outside our orbit today, but if BLKCF is working along those lines, they could be the first real proof that this technology has the real-life disruptive power its fans dream about.)

And whenever blockchain creates new currencies, BLKCF is open to the potential. That Ethereum solution could bring Bitcoin-like transactions to the old-fashioned world of moving money around to actually buy and sell stuff. Move over Visa, Mastercard and PayPal!

BLKCF just introduced the Laser Network, the SWIFT for Blockchain. Laser works by operating on top of any existing blockchain network and optimizes its functions – which includes the ability to operate with other blockchains. Laser with these new and unique features seeks to play a central role in the growth of all Blockchains by for the first time allowing interoperability between Blockchains! Laser will feature the use of an overlay protocol that provides “pseudo confirmation” of transactions, enabling any two cryptocurrencies to be transacted in a matter of seconds and will feature a service to make transactions anonymous in any cryptocurrency.

And then there are the “gaming networks” and that “securitization platform for artworks.” From the headline flow, these are probably the pieces that are farthest along, moving fastest and occupy the biggest share of BLKCF management’s brainpower . . . this is where the stock gets its “oomph” now.

It’s not exactly trivial stuff. BLKCF has MILLIONS invested in these plays. The goal is naturally to hit one or more home runs in the foreseeable future. Start with the games. This tiny little company has at least $12 million staked on strategic bits of various sports and gaming companies: Breaking Data Corp. (which runs GIVEMESPORT and a 119 million fan network) and Millennial ESports Corp. (racing apps, in-game currency).

That’s a lot of dots to connect, but the blockchain angle shows up loud and proud when you do it. The game company provides the software and the drive to create new digital “currencies” in order to run in-game purchasing. That part could be true genius: suddenly “money” becomes whatever token or credit the designers can dream up!

With GIVEMESPORT on deck, BLKCF can market to one of the biggest captive sports social networks around, 45% bigger than mighty ESPN on Facebook alone.

Then there’s the art piece. Remember the Kodak coin? Last month shares of tired old Eastman Kodak (remember them? they made “cameras”) quadrupled when the company announced that it wanted to launch its own crypto currency.

This one started out as a way to track photo rights to crack down on image pirates — reading between the lines, if you want to protect a picture, pay the photographer or just make sure you’re not stealing the rights, you’d have to deal with Kodak and its blockchain.

But the buzz only stops at pictures because Kodak used to be a camera company. Once they work out the kinks, blockchain can protect movies, songs, books tighter than the best anti-piracy codes of previous generations.

Long story short, BLKCF paid $2 million to buy EVERY SINGLE ONE of the initial Kodak coins. They run that niche. The last time I did the math, every BLKCF share now incorporates 0.44 of one of those Kodak coins . . . in addition to the games, the sports and the mining operation itself.

Add it all up, the fork has been good to this chart so far. As that fork recedes in the rear view, we may not even miss the Bitcoin piece.

That said, your fellow traders may not have put it all together yet. BLKCF is the kind of stock where 1+1 can literally add up to 3 under the right conditions, thanks to blockchain logic.

Disclaimer :

This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on BLKCF (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.

Savvy Trader Resource profiles are not a solicitation or recommendation to buy, sell or hold securities. Savvy Trader Resource is a paid advertiser and is not offering securities for sale. Neither Savvy Trader Resource nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Savvy Trader Resource its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.

Savvy Trader Resource does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.

Information presented by Savvy Trader Resource may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.

THIS SITE IS PROVIDED BY SAVVY TRADER RESOURCE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SAVVY TRADER RESOURCE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.

TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SAVVY TRADER RESOURCE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SAVVY TRADER RESOURCE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SAVVY TRADER RESOURCE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SAVVY TRADER RESOURCE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

By using Savvy Trader Resource, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.

The website contains links to other related World Wide Web Internet sites and resources. Savvy Trader Resource is not responsible for the availability of these outside resources, or their contents, nor does Savvy Trader Resource endorse nor is Savvy Trader Resource responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Savvy Trader Resource be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.

You agree to indemnify and hold Savvy Trader Resource, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.

Savvy Trader Resource is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (the “Information”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, savvytraderresource.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, BLKCF Global Blockchain Technologies Corp. Savvy Trader Resource has previously been hired by a third party, Sunrise Media LLC., for a period beginning on November 19th 2017 to publicly disseminate information about (BLKCF) via website and email. We have been compensated $482,000. Savvy Traders Resource has also been hired direct by

Global Blockchain Technologies Corp, for a period beginning on March 1, 2018 to publicly disseminate information about BLKCF in the amount of $10,000. We will update any changes to our compensation. We own zero shares of (BLKCF).

During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.

The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.

All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.

We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.

The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.

We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.

We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.

There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.

We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information

We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.

We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.

Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.

We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.

If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.

The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.

The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.

You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.

When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.

The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.

We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.

If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.

If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.

The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.

Savvy Trader Resource , reserves the right, at its sole discretion, to change, modify, add and or remove all or part of this Disclaimer and or Terms of Use at any time.